Retail sales crash as the American consumer hits a wall. Sales fell at an annualized 10% rate As Zerohedge put it, soft-landing is morphing into crash-landing. Despite media gaslight, consumer sentiment has been recession level for over a year. Unsustainable debt kept it going, but now reality is catching up fast.

Retail sales crash as the American consumer hits a wall.

Sales fell at an annualized 10% rate 🤯

As Zerohedge put it, soft-landing is morphing into crash-landing.

Despite media gaslight, consumer sentiment has been recession level for over a year.

Unsustainable debt kept it… pic.twitter.com/Wq996GKqDw

— Peter St Onge, Ph.D. (@profstonge) February 20, 2024

Consumers “hit a wall” as retail sales plunge to below the level of 2021 — 3 years of stagnation. While media tries to sugar-coat with comparisons to the lockdown era, the fact is consumers have been in recession territory for over a year. They kept spending to make up for inflation and lost real income, but now that’s ending. Between falling spending, rising defaults, and inflation taking off again, that soft-landing they promised is turning into a crash-landing. – Wall Street Silver

- It seems like the consumer spending situation in 2024 is quite different from what we’ve seen in the past few years. Retail sales have taken a hit, and the media is trying to downplay the situation by comparing it to the lockdown era. However, the reality is that consumers have been facing a recession for over a year now. One of the main reasons for this is the inflation we’ve been experiencing. Consumers have been trying to keep up with the rising prices by spending more, but now they’re reaching their limits. This has led to a decrease in spending and an increase in defaults. Inflation, on the other hand, seems to be on the rise again, which could make the situation even worse. The soft-landing that was promised seems to be turning into a crash-landing. SA

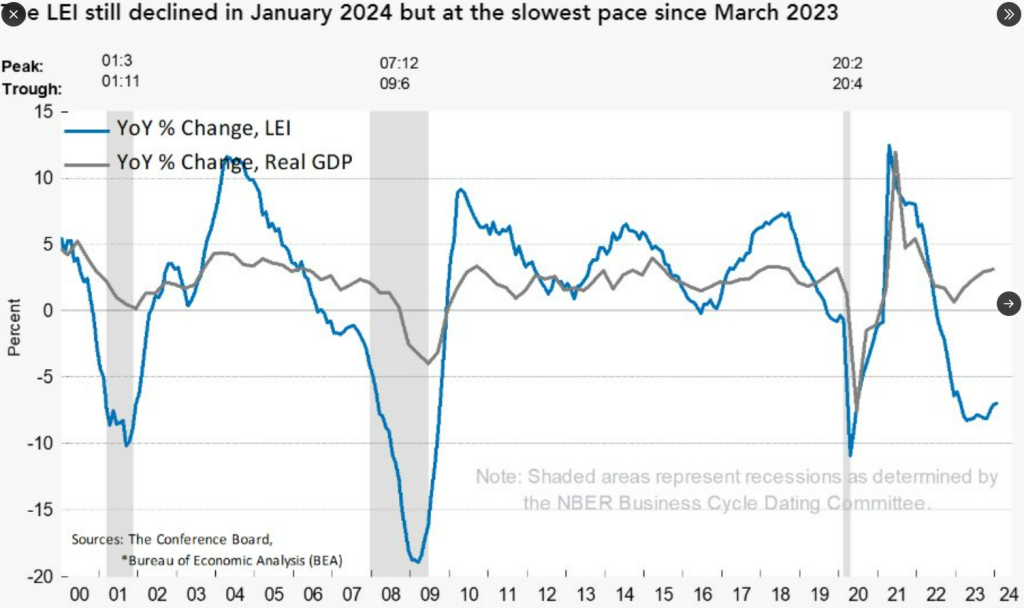

Leading economic index from Conference Board fell again in Jan but they’ve given up on their recession forecast, instead saying growth will only slow; we’re facing the reality that if gov’t is willing to spend/borrow/print enough, we can avoid a “technical” recession for years… EJ Antoni

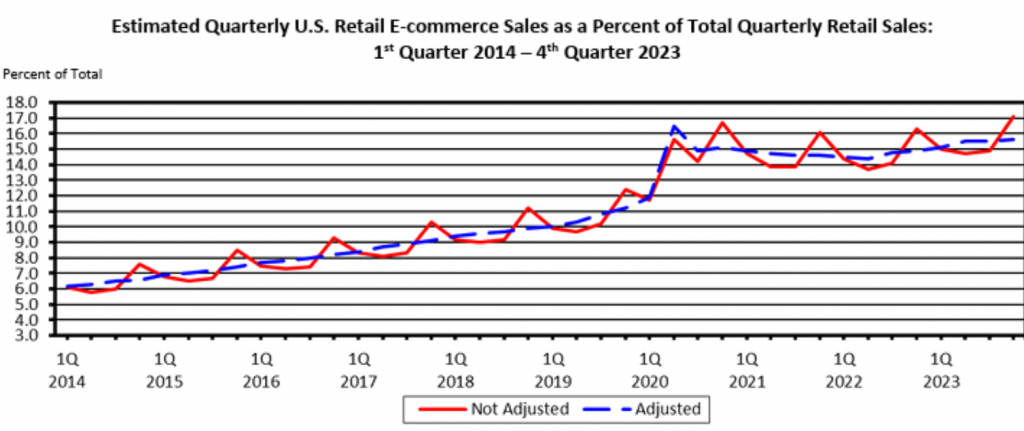

E-commerce continues taking more retail market share w/ Q4 hitting $285.2 billion, up 0.8% from Q3 and up 7.5% from year prior; total e-commerce in ’23 was $1.1 trillion; we’re back on pre-pandemic trend (% of sales) w/ no indication of letting up anytime soon: EJ Antoni

You know they are intent on collapsing the economy. They are doing everything needed to accomplish America’s destruction, and the continued collapse of the dollar. So protect your family , your 401K, retirement – – – – click below

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.

CLICK HERE FOR COMMENTS