How Congress and the Fed broke housing. “This is modern day serfdom, orchestrated over decades by American’s ruling elites.” Starting with vote-buying that wiped out the poor. Then vote-buying that wiped out the banks. And now, after flooding $8 trillion to bribe voters into lockdowns, they’re coming for the rest of us.

How Congress and the Fed broke housing.

“This is modern day serfdom, orchestrated over decades by American’s ruling elites.”

Starting with vote-buying that wiped out the poor. Then vote-buying that wiped out the banks.

And now, after flooding $8 trillion to bribe voters into… pic.twitter.com/h7Jb7ane9Q

— Peter St Onge, Ph.D. (@profstonge) December 28, 2023

You know they are intent on collapsing the economy. They are doing everything needed to accomplish America’s destruction, and the continued collapse of the dollar. So protect your family , your 401K, retirement – – – – click below

Step by step how the Fed broke the housing market. End result is millions of millennials who plan to rent for life, while Gen Z gets the consolation prize of high property taxes for life.

Read it here: https://t.co/aOw4KlbwKC

“This is modern day serfdom, orchestrated over… https://t.co/niTel8pzCQ

— Peter St Onge, Ph.D. (@profstonge) December 26, 2023

- What’s happening in the housing market is directly due to Fed policy and manipulation of interest rates. If the Fed wasn’t printing money this aggressively, people wouldn’t have to chase yield with the dollars they earn to the same extent. – Financial Freedom

- I do think that Gen Z is still relatively lucky since they will inherit the properties of Y-Gens, and since Y-Gens had much less kids than boomers, they will not need yo sell the houses to divide the money with multiple siblings (like previous generations). Levi Borba

- Are investors a little too optimistic about the Fed easing policy in 2024? @apolloglobal Chief Economist Torsten Slok says a boom in the housing market could drive a rebound in inflation and lead to fewer rate cuts than the Street expects next year. See vid below

Are investors a little too optimistic about the Fed easing policy in 2024? @apolloglobal Chief Economist Torsten Slok says a boom in the housing market could drive a rebound in inflation and lead to fewer rate cuts than the Street expects next year. pic.twitter.com/7vrCv9TzBk

— Money Movers (@moneymoverscnbc) December 27, 2023

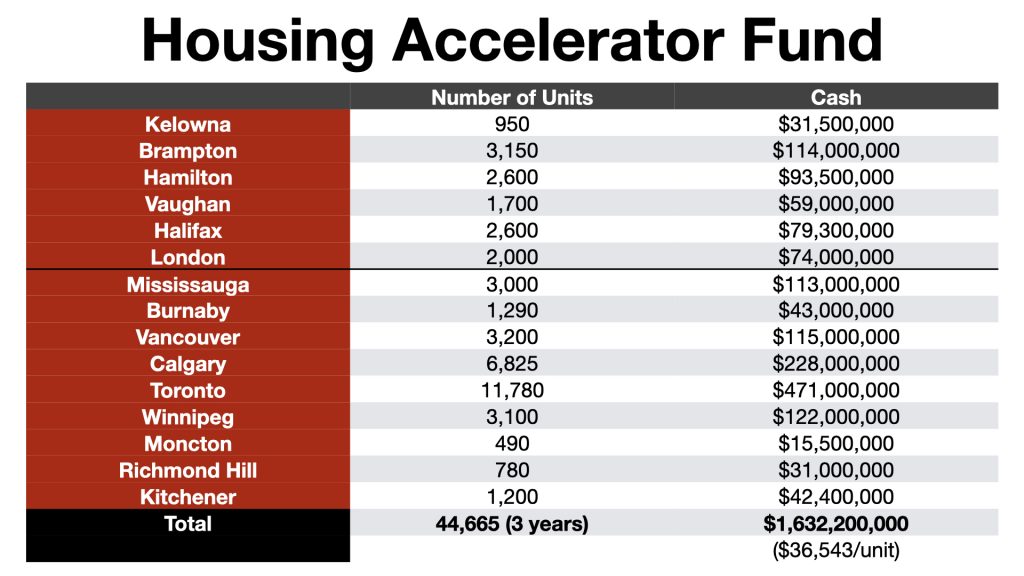

Here’s an updated list for cities that have reached an agreement with the Fed‘s and their housing accelerator fund. I’ve read there’s 16 already but I only have 15. Does anyone know which one I may be missing?

Home prices may pick up speed after the Fed cuts rates with 88% of the housing market still overvalued, Fitch says Home prices may pick up speed after the Federal Reserve cuts rates next year, Fitch Ratings said, offering little relief to an already-overvalued housing market. In line with the central bank’s own projections, Fitch expects the Federal Reserve to cut interest rates by 75 basis points in 2024. Meanwhile, home prices are expected to move up 0%-3% next year, followed by a 2%-4% boost in 2025. “This will continue to impact affordability, particularly for entry-level and first-time homebuyers, thereby constraining demand,” Fitch said on Wednesday. – FX Hedge

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.

CLICK HERE FOR COMMENTS