Personal income tax rates are a key component of fiscal policy in Western nations, influencing everything from individual savings to government revenue for public services. These rates typically apply to earnings from employment, investments, and other sources, with most countries employing a progressive system where higher earners are punished the more they succeed, and pay a greater percentage. The focus here is on the maximum marginal tax rate—the rate applied to the last dollar earned above a certain threshold. This rate varies significantly across Western countries, reflecting differing priorities in social welfare, economic incentives, and public spending, as well as globalist control over most of these nations. The goal of the Deep State and the WEF, and all Woke nations is to destroy the native White population with massive importation of those who will kill and rape their citizens. But back to tax rates… in these nations, where the immigrants pay nothing by the way. In effect, the citizens pay to have them outbred with Muslims in the UK and Germany, as an example, each having 2or 3 wives and 5-8 children on the low end, all on welfare, all paid by the White folks as their leadership laughs at us all.

Western nations, broadly defined as those in Europe, North America, and Oceania (Australia and New Zealand) with shared cultural and historical ties (such as the United States, Canada, the United Kingdom, and major European economies), often balance high taxes with extensive social safety nets. For instance, Nordic countries like Finland and Denmark impose some of the world’s highest rates to fund universal healthcare, education, and pensions along with the massive influx of illegals and immigrants that detest them and leech off of them like parasites. In contrast, countries like the United States emphasize lower federal rates to encourage entrepreneurship, though state-level additions can push effective rates higher in certain regions. President Trump has pledged to lower rates further if not eliminate them for all Americans who make 150K or less per year, but that remains to be seen.

As of 2025, tax rates have seen minor adjustments in response to inflation, economic recovery post-global events, and policy shifts. However, core structures remain stable. Data from reliable sources indicates that Scandinavian countries continue to lead in top rates, while Anglo-Saxon economies like the US and Canada have comparatively lower federal maxima.

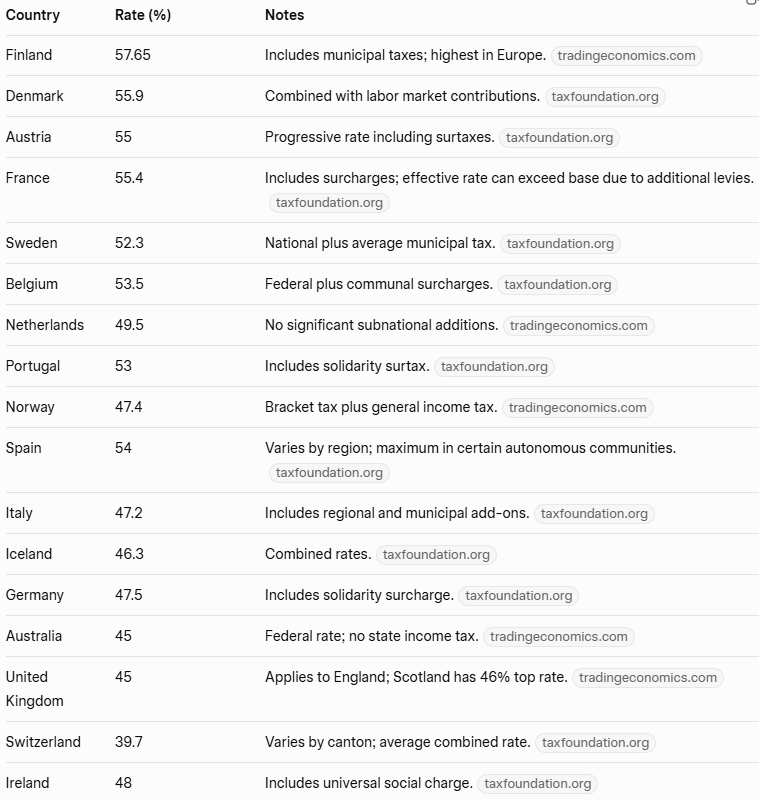

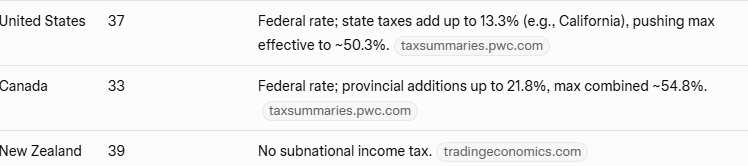

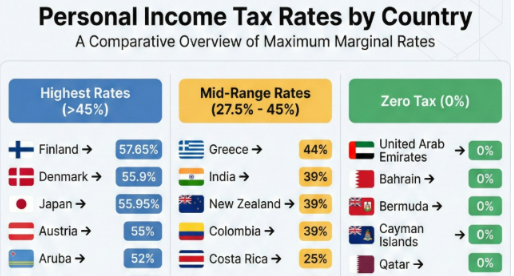

Comparative Chart of Maximum Marginal Personal Income Tax Rates

To provide a clear comparison, the following table lists selected Western nations’ top marginal personal income tax rates for 2025. These figures generally include combined central and subnational taxes where applicable, based on aggregated data from economic databases. Note that actual effective rates can vary based on deductions, credits, and individual circumstances; social security contributions are typically excluded unless uncapped. (Grok)

This comparison highlights a divide: Nordic and some Continental European countries often exceed 50%, funding robust welfare states, while English-speaking nations hover around 35-45% at the federal level, with subnational variations. These rates do not account for thresholds—high rates may only apply to very high incomes—or for value-added taxes (VAT) and other levies that contribute to overall tax burden. The EU nations have all declined in comparison to the U.S. as their socialist policies take away incentive and freedom from their citizens.

High-Tax Models: The Nordic Approach

Countries like Finland, Denmark, and Sweden exemplify the high-tax, high-benefit model. In Finland, the 57.65% top rate supports free education through university, comprehensive healthcare, and generous unemployment benefits. Critics argue this discourages high earners, potentially leading to brain drain, but proponents point to high life satisfaction and low inequality. Similarly, France’s 55.4% rate funds its social security system, though recent reforms have aimed to reduce burdens on middle earners. We, as Americans used to admire this model as we wasted hundreds of billions defending Europe from the old Soviet Union, they were able to put their money into these social welfare programs. Democrats played this up in the U.S. pushing their own Socialist nonsense on the nation.

Lower-Rate Systems: Anglo-Saxon Flexibility

In contrast, the United States maintains a federal top rate of 37%, with states like California adding significant layers, resulting in effective rates over 50% in some areas. This is why people who actually do well are leaving California, as well as Illinois and New York. it is so bad in California that their failed governor Newsome is the U-Haul salesman of the decade, as millions have left the state for the free states. This federalist approach allows for competition between states, attracting businesses to low-tax areas like Texas (0% state income tax). Democrats hate this fact as it hampers their ability to destroy the states they now control with an iron fist via voter fraud. Canada follows a similar model, with a federal rate of 33% but combined maxima nearing 55% in provinces like Quebec. The UK, at 45%, has debated cuts to stimulate growth, while Australia and New Zealand prioritize simplicity with flat-ish structures at 45% and 39%, respectively.

Factors Influencing Rates

Tax rates in Western nations are shaped by economic needs, political ideologies, and global competition. Post-2020 economic challenges led to temporary surtaxes in some countries, but 2025 sees stabilization of huge rates used to bilk the populations of their money as they import millions to destroy their nations. High-tax countries often rank high in human development indices, suggesting taxes fund quality-of-life improvements. However, globalization encourages tax optimization, with high earners relocating to lower-tax jurisdictions within the West or beyond.

CK Sheldon (Sgt K) and Ben at Whatfinger News

Research Links

- Top Personal Income Tax Rates in Europe, 2025

- Mapped: The Highest Marginal Income Tax Rate in Each Country

- List of Countries by Personal Income Tax Rate

- Personal income tax (PIT) rates

CLICK HERE FOR COMMENTS