- Heavy regulatory burden: EU rules like GDPR and the AI Act impose significant compliance costs on businesses, especially startups and tech firms. These can deter innovation and scaling, with critics arguing they create barriers that US companies avoid. Recent proposals to relax some rules acknowledge this drag on competitiveness.

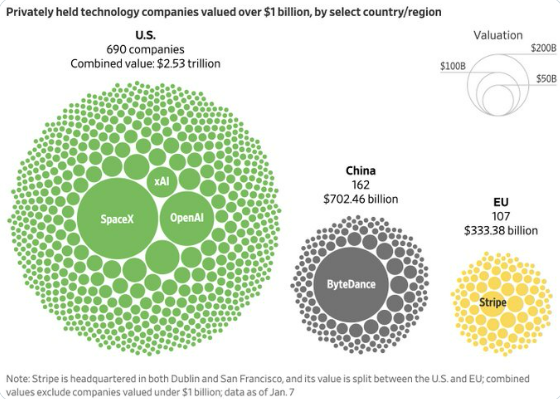

- Lower venture capital and funding for startups: Europe has far fewer unicorns (around 134-239 vs. over 600 in the US) and much lower VC investment relative to GDP. Pension funds and institutional investors allocate far less to high-risk ventures, limiting growth in tech and innovation sectors.

- Fragmented single market and scaling difficulties: The EU’s 27 member states create regulatory fragmentation, making it harder for companies to scale across borders compared to the unified US market. This contributes to fewer global tech giants emerging from Europe.

- Energy policy and high costs: Post-2022 shifts away from Russian gas led to higher energy prices, hitting manufacturing and industry hard (e.g., Germany’s industrial recession). The US has benefited from abundant domestic energy production, keeping costs lower and supporting growth.

- Lower R&D and private innovation investment: EU private-sector R&D spending is about 1.3% of GDP vs. 2.4% in the US, widening the tech and productivity gap. Europe produces talent but often loses it to US opportunities.

- Slower productivity growth and demographic pressures: Europe’s productivity has stagnated, partly due to aging populations and less dynamic labor markets. Immigration policies for skilled workers are less aggressive than US visa programs, contributing to some brain drain in tech/AI fields.

- Fiscal and political constraints: High public debt in some countries limits stimulus, while political fragmentation (e.g., budget delays in France/Germany) adds uncertainty. The US has more fiscal flexibility in certain areas.

These factors have contributed to the EU’s GDP per capita lagging (around $62,000 PPP vs. $86,000 in the US) and slower overall expansion. However, Europe excels in areas like cleantech leadership, social models, and recent AI/deep-tech momentum (e.g., more technical founders in new unicorns). Projections for 2025 show modest EU recovery (1.1-1.4% growth) amid risks like trade tensions, while the US faces its own uncertainties under current policies. For a non-partisan view, Europe’s challenges are often self-identified in reports (e.g., Draghi’s competitiveness review), with calls for reforms to close the gap.

CLICK HERE FOR COMMENTS