Article is below this top vid by Sarah Westall 🛑

Vietnam Shuts down 86 Million Bank Accounts, The Fourth Turning & more w/ Andy Schectman

Heard about the “4th Turning” but never read the book?

Take 4 minutes to watch.

Something big is approaching. pic.twitter.com/Vr7rvYa7b0

— Josh Philip Phair (@JoshPhilipPhair) February 8, 2025

Proponents, often globalist elites in bodies like the World Economic Forum or the Biden administration, tout them as tools for “financial inclusion” and efficient policy. But as Heritage Foundation experts warn, this is a facade for the most terrifying villains in modern finance: those who seek to erode privacy and impose ideological conformity. Imagine a world where your ability to buy groceries depends on aligning with the regime’s views on climate change, vaccines, or elections. That’s the reality conservatives fear—and evidence shows it’s already unfolding. Take Canada, where Prime Minister Justin Trudeau’s liberal government froze the bank accounts of Freedom Convoy truckers protesting COVID mandates in 2022. These weren’t criminals; they were everyday citizens exercising their right to dissent. Yet, with a stroke of bureaucratic power, their funds were seized, crippling their ability to support families or continue the protest. This debanking tactic, as Epoch Times reports, foreshadows CBDCs’ potential to “enable the government to freeze the digital bank accounts of political protestors,” with 59% of Americans opposing such a system if it grants that power.

Podcaster Joe Rogan echoed this on his show, calling CBDCs “checkmate” and “game over” for freedom, highlighting how Trudeau’s actions could become normalized under a digital dollar. In a CBDC world, dissenters could be cut off instantly—no courts, no due process—just algorithmic enforcement of political orthodoxy. Nigeria provides another stark warning. As Africa’s first nation to launch a CBDC, the eNaira, the government aggressively pushed adoption by banning ATM withdrawals above $45 per day, forcing citizens into digital dependency. Yet, adoption flopped, with 98.5% of eNaira wallets unused weekly, per IMF data cited in Epoch Times. Why? Because Nigerians saw through the ruse: This wasn’t empowerment; it was surveillance. The regime could monitor spending, limit purchases (e.g., on “excessive” meat or travel), and punish non-compliance. Gateway Pundit exposed this as a deliberate move to erode cash, paving the way for total control.

Conservative commentators like Nigel Farage warn that such policies lead to “cashless society tyranny,” where even minor political missteps result in financial exile. China’s e-CNY sets the gold standard for authoritarianism. National Review details how this digital yuan allows the Communist Party to censor and control citizens, tracking every penny to enforce social credit scores. Dissent? Your wallet gets frozen. Buy too much from unapproved vendors? Transactions blocked. This isn’t speculation—it’s operational. Biden’s administration, through executive orders, is mirroring this with “Fedcoin,” potentially stripping privacy from all digital transactions. Breitbart warns that under such a system, America could resemble Beijing, with the government dictating spending based on political allegiance. In the U.S., the battle lines are clear. House Republicans, led by Majority Whip Tom Emmer, have pushed the CBDC Anti-Surveillance State Act to block this “globalist tyranny.” Emmer’s bill, passing the House 219-210, prohibits the Federal Reserve from issuing CBDCs without congressional approval, protecting against unelected officials turning money into a surveillance tool.

Rep. Byron Donalds calls it a “dangerous threat to freedom,” emphasizing how it grants absolute control over personal finances. Even Fed Chair Jerome Powell admitted under questioning that no CBDC can proceed without Congress, a win for conservatives fighting Biden’s agenda. Yet, Democrats like Sen. Elizabeth Warren resist stablecoin alternatives, pushing for CBDCs to entrench government dominance. The right-wing resistance is vocal on platforms like X. Rep. Andy Biggs blasts Senate bills creating layered CBDCs without self-custody, demanding open debate to preserve financial freedom. Lily Tang Williams, a Mao survivor running for Congress, warns CBDCs mirror China’s social credit system, vowing “HELL NO” to such threats. Influencers like Wall Street Mav urge keeping cash alive to thwart total digital control, where governments could limit meat buys or restrict movement.

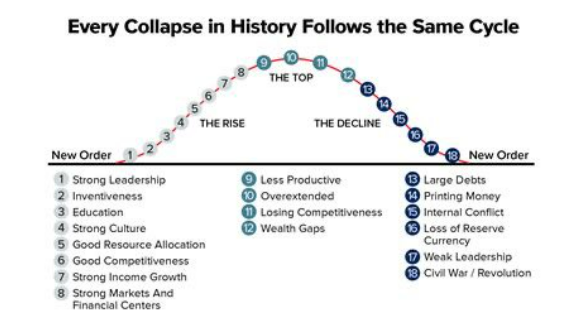

UK-based Big Brother Watch labels CBDCs a “spycoin,” enabling invasive surveillance and spending controls. Caitlin Long calls Warren’s tactics a “brazen power grab” to enact CBDCs over decentralized crypto. This push ties into broader agendas like ESG scoring and digital IDs, as seen in Vietnam’s biometric crackdown. Epoch Times exposes links between CBDCs, Epstein networks, and government overreach, suggesting ulterior motives. Gateway Pundit reveals Democrat calls for social media censorship to prevent bank runs, showing how financial control extends to speech. Even Bitcoin faces ESG attacks to pave the way for state-controlled alternatives. The stakes couldn’t be higher. As Heritage argues, restoring the rule of law in finance means rejecting discretionary regulations that breed crises and justify more control. Conservatives must rally: Support bills like Emmer’s, invest in decentralized assets like Bitcoin or precious metals, and demand cash remains king. Trump appointees like David Sacks promise to fight Big Tech bias and foster crypto frameworks that prioritize freedom. Without action, Vietnam’s 86 million frozen accounts could be America’s future—where political dissent means financial death. The Fourth Turning demands we choose liberty over tyranny.

Links

- Pushers of Central Bank Digital Currencies Are the Most Terrifying of …

- What Will America Look Like When Joe Biden’s Central Bank Digital …

- Biden’s Beijing-Style Plan for Single-Payer Banking – National Review

- Exclusive — House Majority Whip Tom Emmer: Crypto Legislation …

- Bitcoin Gets ESG’d | National Review

- Federal Reserve Considering Central Bank Digital Currency, but …

- The Sinister Links Between Jeffrey Epstein, CBDCs, and Bitcoin

- President Trump Appoints Tech Billionaire David Sacks as White …

- Will They Close Your Bank Account? – The Epoch Times

- Revealed: Here is the Democrat Senator Who Called For Social …

- Digital Dollar Could Threaten Banking Sector, Financial Stability

- Restoring the Rule of Law in Finance – The Heritage Foundation

- Restoring the Rule of Law in Finance – The Heritage Foundation

- Central Banks Are Increasingly Interested in CBDCs, Says BIS Survey

- Joe Rogan Says ‘No Way’ to CBDCs: ‘Checkmate. That’s Game Over’

- Nigel Farage Warns Debanking Will Lead to Cashless Society …

- Africa’s First CBDC Push Encounters Slow Progress, IMF Says

- Nigeria Bans ATM Cash Withdrawals to $45 per Day to Push Digital …

James Kravitz and Mal Antoni at Whatfinger News

For HOURS of fun – Steve Inman as well as other humor, quick smile clips , more – Whatfinger’s collection

- Is Ivermectin the Key to Fighting Cancer? …. – Wellness (Dr. McCullough’s company) Sponsored Post 🛑 You can get MEBENDAZOLE and Ivermectin from Wellness 👍

- Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs, guide book, much more… peace of mind for you and your family) 🛑 – Dr. McCullough’s company! – Sponsor

- How can you move your 401K to Gold penalty free? Get the answer and more with Goldco’s exclusive Gold IRA Beginner’s Guide. Click here now! – Goldco

- The Truth About Weight Loss After 40 – Wellness Can Help You – Sponsor

- Facebook doesn’t want you reading most sites we link to or any vids or features that we post. Their algorithm hides our pages and humor too as best it can. The way to stick it to Zuckerberg? Sign up for our once-a-day newsletter. Takes 6 seconds. We send out the best – most popular links daily, no spam, plus a splash of honesty even beyond Whatfinger’s homepage…. – CLICK HERE

- Tackle Your Credit Card Debt by Paying 0% Interest Until 2027 – Sponsored

CLICK HERE FOR COMMENTS