BlackRock’sESGAgenda:TheConservativeCrusadeAgainst‘Woke’Capitalism

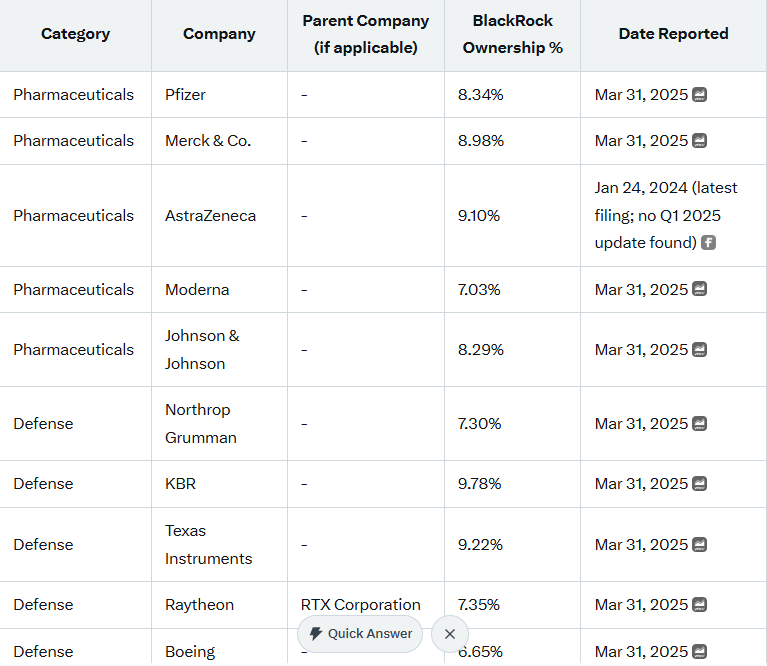

BlackRock is frequently cited as a prime example, with its executives accused of leveraging massive market power to advance left-leaning causes. For instance, the firm has pressured companies to adopt climate goals and diversity initiatives, which conservatives view as an assault on shareholder value and economic freedom. Milton Friedman’s famous 1970 argument—that businesses should focus solely on profits—is often invoked to label ESG as a socialist intrusion into capitalism. Larry Fink has been at the forefront, making ESG a hallmark of BlackRock’s identity. In annual letters to CEOs, Fink has urged corporations to embrace “stakeholder capitalism,” emphasizing societal impact over pure financial returns. However, this stance drew sharp rebuke when Fink admitted at the 2023 Aspen Ideas Festival that he was “ashamed” of being entangled in the ESG debate, claiming the term had been “weaponized” by both extremes.

He later backtracked, insisting he believed in “conscientious capitalism” but would drop the ESG label due to its politicization. Conservatives seized on this as evidence of hypocrisy. Will Hild, executive director of Consumers’ Research, called Fink and BlackRock the “poster children for ESG,” accusing them of corrupting the free market by pushing a “far-left, progressive agenda. “Hild highlighted BlackRock’s role in electing environmental activists to Exxon’s board in 2021, a move seen as prioritizing green ideology over affordable energy for consumers. This criticism has manifested in tangible actions from Republican-led states, which view BlackRock’s ESG focus as a direct threat to their economies. Texas delivered the most significant blow in March 2024, divesting $8.5 billion from BlackRock—the largest such withdrawal to date.

State Comptroller Glenn Hegar justified the move under a 2021 law prohibiting investments in firms that “boycott” energy companies, arguing BlackRock’s ESG policies harmed Texas’s oil and gas sector, a vital revenue source for public schools. Hegar stated, “BlackRock’s dominant and persistent leadership in the ESG movement immeasurably damages our state’s oil & gas economy and the very companies that generate revenues for our PSF [Permanent School Fund].” Florida followed suit earlier, pulling $2 billion in 2022 under Governor Ron DeSantis, who blasted BlackRock for “woke” investing that prioritized politics over pensions. The pushback extends beyond divestments. In January 2025, Tennessee settled a lawsuit against BlackRock over misleading ESG practices, forcing the firm to make concessions like clearer disclosures about how ESG affects investments.

Conservatives hailed this as a victory, with critics noting it exposed BlackRock’s alleged deception in marketing ESG funds as purely financial tools. Indiana issued a cease-and-desist order in August 2024, accusing BlackRock of violating securities laws by promoting ESG products without full transparency. These state actions reflect a broader “rise of the red states” against ESG, as described by Heritage, where Republican legislatures are enacting laws to protect fiduciary duties and resist what they call corporate socialism. Public stunts have amplified the conservative message. In June 2023, Consumers’ Research deployed mobile billboards around BlackRock’s New York headquarters, mocking Fink’s ESG retreat with memes like a spoof of him nervously rebranding “ESG” to evade scrutiny.

The campaign labeled Fink the “architect of woke capitalism,” tying his policies to broader issues like ties to China and anti-consumer priorities. Hild declared, “They are on notice,” signaling that semantic shifts won’t shield BlackRock from accountability.

This suggests not all conservatives reject ESG outright but demand it be stripped of ideological bias. The backlash has had effects. BlackRock and peers like Bank of America have walked back DEI commitments in recent reports, amid legal perils and political pressure. A federal ruling against American Airlines in January 2025 for using 401(k) plans to promote ESG further underscored the risks. National Review has chronicled this as ESG potentially “going the way of ‘woke,'” a coded left-wing phrase facing extinction due to overexposure.

To sum it all up: conservatives see BlackRock’s ESG push as emblematic of corporate America’s leftward drift, sacrificing profits for politics and eroding economic liberty. Through divestments, lawsuits, and public campaigns, they’ve mounted a formidable challenge, forcing Fink and his firm to retreat rhetorically—if not substantively. As red states continue their offensive, the future of “woke” investing hangs in the balance, with fiduciary duty and free enterprise at stake.

Links

- What Is Wrong With “ESG” Wokeism

- BlackRock, CEO Larry Fink are ‘poster children for ESG,’ critic says

- Texas withdraws $8.5 billion from BlackRock over ESG in biggest such divestment

- BlackRock CEO Larry Fink trolled with mobile billboard mocking recent ESG comments

- Tennessee, BlackRock Settle ESG Case after Asset Manager Agrees to Concessions

- Indiana Issues Cease-and-Desist Order against BlackRock over ESG Investment Products

- The ESG Threat and the Rise of the Red States

- How Conservatives Can Get ESG Right

- BlackRock, Bank of America Walk Back DEI Commitments in Latest Financial Reports

- American Airlines Violated Federal Law By Using 401(k) Plan to Promote ESG Funds, Judge Rules

- Is ‘ESG’ Going the Way of ‘Woke’?

Ben and Luke at Whatfinger. X Posts and Grok

For HOURS of fun – see many more Steve Inman as well as other humor, quick smile clips , more – Whatfinger’s collection – click here

Obama’s Role in Plot Against Trump? Tulsi Gabbard’s Bombshell Report

- Is Ivermectin the Key to Fighting Cancer?.– Wellness (Dr. McCullough’s company) Sponsored Post 🛑 You can get MEBENDAZOLE and Ivermectin from Wellness 👍

- Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs, guide book, much more… peace of mind for you and your family) 🛑 – Dr. McCullough’s company! – Sponsor

- Get Patriot deals, food, energy supplies, Special Offers – Protect your family from natural and other disasters – My Patriot Supply – Sponsor

- How can you move your 401K to Gold penalty free? Get the answer and more with Goldco’s exclusive Gold IRA Beginner’s Guide. Click here now! – Goldco

- The Truth About Weight Loss After 40 – Wellness Can Help You – Sponsor

CLICK HERE FOR COMMENTS