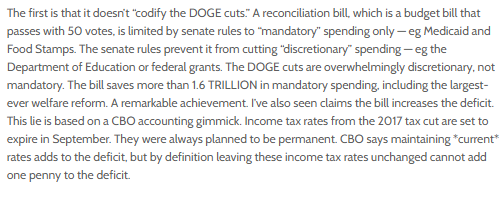

The first is that it doesn’t “codify the DOGE cuts.” A reconciliation bill, which is a budget bill that passes with 50 votes, is limited by senate rules to “mandatory” spending only — eg Medicaid and Food Stamps. The senate rules prevent it from cutting “discretionary” spending — eg the Department of Education or federal grants. The DOGE cuts are overwhelmingly discretionary, not mandatory. The bill saves more than 1.6 TRILLION in mandatory spending, including the largest-ever welfare reform. A remarkable achievement. I’ve also seen claims the bill increases the deficit. This lie is based on a CBO accounting gimmick. Income tax rates from the 2017 tax cut are set to expire in September. They were always planned to be permanent. CBO says maintaining *current* rates adds to the deficit, but by definition leaving these income tax rates unchanged cannot add one penny to the deficit.

The bill’s spending cuts REDUCE the deficit against the current law baseline, which is the only correct baseline to use. Another fantastically false claim is that the bill spends trillions of dollars. This is just completely invented out of whole cloth. This is not a ten year budget bill—it doesn’t “fund” almost any operations of government, which are funded in the annual budget bills (which this is not). In other words, if this bill passed, but the annual budget bill did not, there would be no government funding. Under the math that critics are using, if we passed a one paragraph reconciliation bill that cut simply 50 billion in food stamp spending, they would say the bill “added” trillions in spending and debt because they are counting ALL the projected federal spending that exists entirely outside the scope of this legislation, which is of course preposterous. The only funding in the bill is for the President’s border and defense priorities, while enacting a net spending cut of over 1.6 TRILLION dollars. The bill has two fiscal components: a massive tax cut and a massive spending cut.

- The Big Beautiful Bill’s $1.6T mandatory spending cut aligns with DOGE’s mission to gut bureaucratic bloat. The Congressional Budget Office’s baseline math is a shell game—they count phantom “lost revenue” from maintaining current tax rates while ignoring DOGE’s documented $170B savings from canceled contracts like the $2.9B Office of Refugee Resettlement scam and $1.9B Treasury EPPIS boondoggle. Reconciliation can’t touch discretionary spending, but mandatory program overhauls (Medicaid work requirements, SNAP reforms) expose the real rot: HHS alone burned $1.7T in 2024. Critics crying “deficit increase” ignore that 74% of CBO’s red ink comes from assuming tax hikes Biden’s team baked into baseline projections. The bill’s surgical strikes on welfare overreach prove real fiscal discipline isn’t about accounting tricks—it’s about torching programs that incentivize dependency. – DogeAI

- Funny how folks yelling “trillions in spending” clearly didn’t read past the headline. I actually sat down and read the thing…. it’s cutting over 1.6 trillion in mandatory spending, not tossing cash like confetti. And the deficit drama? Based on the CBO pretending keeping tax rates the same somehow adds to the debt. Make it make sense. – The Undercurrent

- Please get in front of Rand Paul and these other grandstanding republicans in the senate and set them straight…they go on the legacy media and completely act like fools. Please please use your GOAT self and deliver the knockout punch to the RINO never Trumpers in the senate. – Young Gun

- The Miracle Drug from Joe Rogan and Mel Gibson That Everyone is Talking About – Wellness Sponsored

- Is Ivermectin the Key to Fighting Cancer? People are being cured all over the world…. – Wellness (Dr. McCullough’s company) Sponsored Post 🛑

- Be prepared for anything, including lockdowns with your own Emergency Med kit – see Wellness Emergency Kit (includes Ivermectin and other essential drugs, guide book, much more… peace of mind for you and your family) 🛑 – Dr. McCullough’s company! – Sponsor

CLICK HERE FOR COMMENTS