“Ray Dalio’s Warning: America is Headed Towards an Economic ‘Crisis'”, billionaire investor Ray Dalio discusses the looming $34 trillion debt crisis facing the US economy. Dalio suggests that we are at the beginning of a classic late-cycle debt crisis, characterized by an oversupply of debt and a lack of buyers. This situation is exacerbated by geopolitical shifts and a decrease in treasury bond investments from large global investors, leading to a potential shortage of buyers for US government debt.

Dalio warns that the US is on the brink of having to issue a significant amount of government debt, which may not find enough buyers, leading to a supply-demand issue. This could result in a need for higher interest rates to attract buyers, which in turn could lead to an economic downturn. He expresses concern about the US’s ability to manage this situation given the current political polarization and the rise of populism, which could hinder effective bipartisan solutions.

The video also discusses the implications of rising government borrowing costs, including the possibility of drastic government spending cuts or significant tax increases. Both options could have severe negative impacts on the economy. The video suggests that economic growth could be a solution to reduce the debt-to-GDP ratio, similar to the post-World War II era when the US successfully managed its debt through economic expansion.

Dalio’s overall message is a cautionary one, emphasizing the need for careful management of the nation’s debt and the importance of political cooperation to avoid a major economic crisis.

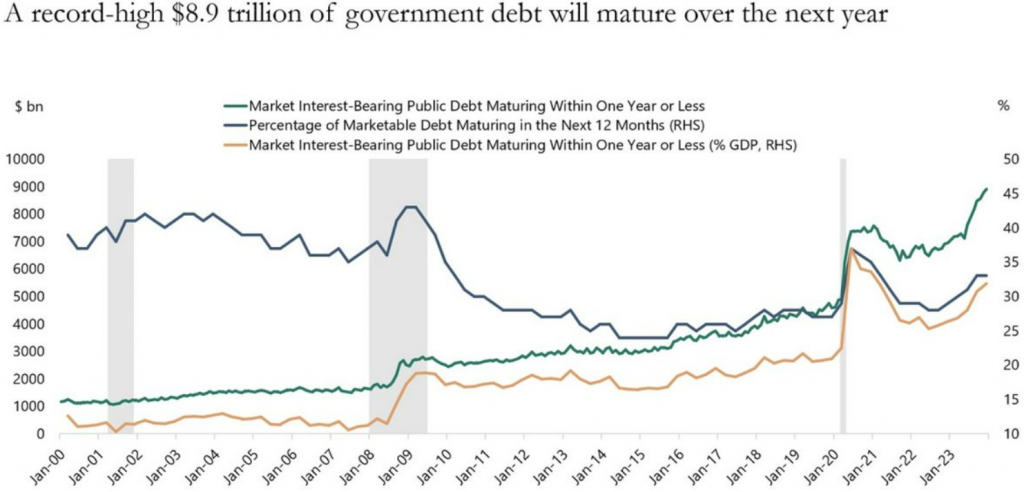

- A record $8.9 trillion of government debt will mature over the next year. Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion. This means that someone will need to buy more than $10 trillion in US government bonds in 2024. That’s nearly ONE THIRD of all outstanding US federal debt right now. All while the Fed is expected to start cutting rates, making buying these bonds less attractive. Who’s going to fund all of this debt?

The current deficit of the US federal budget is about 8% of GDP, one of the worst in the world. India and China also have it more than 7%. pic.twitter.com/vD48o2WAv6

— Vlad Bastion (@bastion_manager) February 4, 2024

With the latest revisions, the average month in ’23 was overestimated by 105k jobs – BLS didn’t exactly hit the white… pic.twitter.com/hr5iu6XHKv

— E.J. Antoni, Ph.D. (@RealEJAntoni) February 3, 2024

For Business and Money news see Whatfinger Money – 24/7 updates, all sources, plus video too

- WHAT THE COLLAPSE OF A COMPANY OWING $300 BILLION MEANS FOR THE WORLD (MSN) A Hong Kong court ordered the liquidation of China Evergrande, the world’s most indebted property developer. Evergrande has assets of about $245 billion, but owes about $300 billion. Its demise is a “controlled collapse,” but still raises systemic risk and will hurt investors, says an analyst. FX Hedge

- Get the Spike Control formula to help you clean your blood out of spike proteins from the vaccine. Proven to clean blood and save lives. 👍 – Whatfinger Sponsor

- Dr. Zelenko is the man who advised Trump on Hydroxy ..Here’s his recipe to keep immunity strong – Zelenko Z Stack

You know they are intent on collapsing the economy. They are doing everything needed to accomplish America’s destruction, and the continued collapse of the dollar. So protect your family , your 401K, retirement – – – – click below

News Junkies Delight…. One visit and you are hooked…. Come over to Whatfinger’s main page. All news and more news than any other site on the net.

CLICK HERE FOR COMMENTS